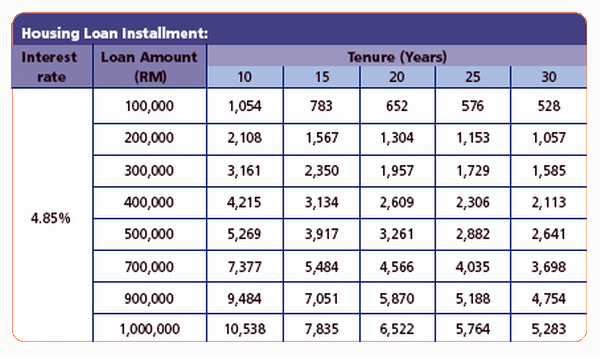

✅Can we stop home loan EMI for a few months?īanks do not allow you to stop paying EMI for a few months and will count it as a loan default in case you fail to pay regularly. Based on the Home Loan interest rate of 7.15%, here is a comparison of EMIs for different tenure: You can use a home loan EMI calculator for 30 years to calculate your housing loan EMI. The EMI for ₹ 30 Lakh will be different for different tenure. ✅What will be the EMI for a ₹ 30 Lakh home loan? The EMI for ₹ 20 Lakh home loan EMI calculator for the top banks gives the following results: The home loan EMI varies from bank to bank based on the rate of interest and tenure. ✅What is the EMI for a ₹ 20 Lakh home loan? The higher the prepayment you make, the lesser the outstanding principal amount. Yes, you can reduce your home loan EMI by making a prepayment for a certain amount. Further, some banks may also have clauses in the loan agreement to reset the benchmark rates and spreads under special circumstances. Your EMIs might also change in a scenario when you decide to prepay a certain percentage of loan amount during the loan tenure. Apart from floating rate loans, EMIs change for partly disbursed loans availed under the tranched EMI scheme, your loan EMI will increase with each disbursement and payment you make to your lender. In the case of floating rate loans, EMI will increase or decrease as per the changes in external benchmark rate linked to home loans such as Repo Rate. Home Loan EMI is fixed only in the case of fixed rate loans.

✅Is the home loan EMI fixed or can it change in future? However, longer loan tenure increases the amount of interest payment which makes your loan repayment costly. If you apply for a longer repayment tenure, your EMI for the loan will be less. The maximum tenure available for a home loan is years. Longer the loan tenure, more the amount of interest for the same loan amount and interest rate. Home EMI calculator also tells you how much interest you would pay over the life of the loan. You need to enter these details in the calculator and to get the desired result. Home Loan EMI Calculator uses a combination of loan amount, tenure and interest rate to calculate housing loan EMI instantly. What are the Benefits of the Home Loan EMI Calculator? However, interest calculation comes to only ₹ 63,260 for 15 years, which is significantly lower than the calculated amount for a 30 Years loan.

However, if the new tenure exceeds the maximum permitted period, the bank may increase your EMI. Generally, the lender will increase the loan tenure while keeping your EMI the same.

It is a kind of home loan that has varying EMI spread over a loan tenure. Flexible EMIs: A step-up home loan offers flexible EMI on a home loan.Below mentioned are some of such instances: However, in certain circumstances, it can change. The housing loan EMI, consisting of principal amount & Interest payment, is usually a fixed amount.

0 kommentar(er)

0 kommentar(er)